How To Pay Tds Challan From Yes Bank

How to check tds challan status online Challan for paying tax on interest income Traces : pay tds / tcs challan online on tin-nsdl

TRACES : Pay TDS / TCS Challan Online on TIN-NSDL | Learn by Quicko

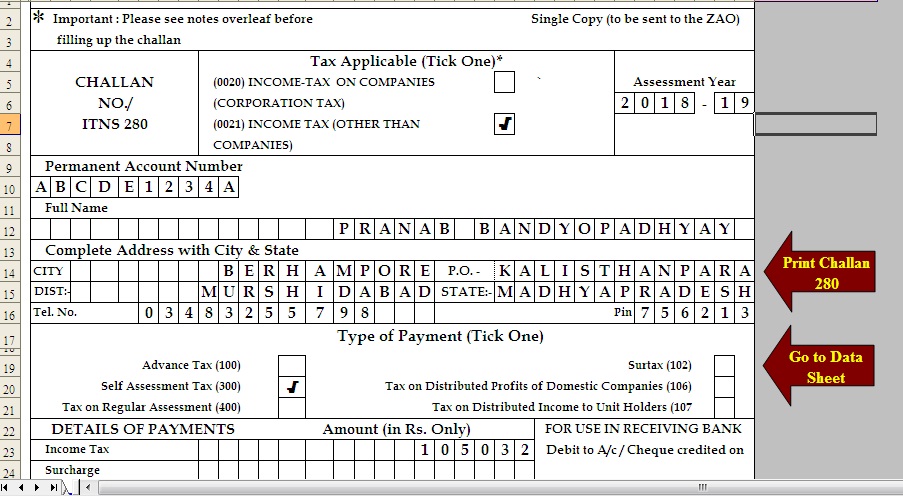

How to fill bank challan How to pay tds challan online through net-banking , upi etc Tds online payment: how to make income tax challan online payment

How to pay tds online? step by step procedure to pay tds online

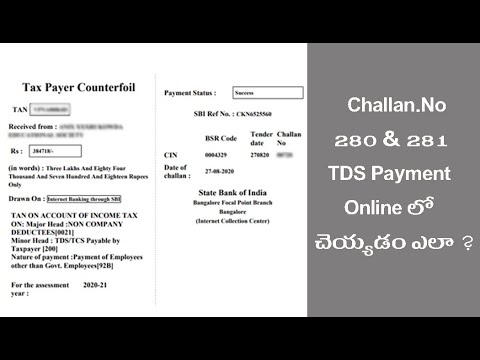

Online tds payment challan 281How to pay tds payment online ? Challan itns payment tds online tcs step head major pay demand appear contd form will required such fill details taxHow to pay tds payment online (challan 281) in india?.

State bank of india tds challanTds payment process online on tin-nsdl Tds payment challan excel format tds challana excel formatHow to pay tds challan online through icici net banking.

How to pay tds challan offline through your bank

Challan tds tcs quicko nsdlChallan income deposit paying How to pay tds onlineHow to pay apsc challan online & offline, details inside.

How to pay online tds/tcs/demand payment with challan itns 281Challan tds itns tcs clicking How to pay tds online? || tds challan payment 281 || hr tutorials indiaChallan tds payment online 281 through.

Traces : pay tds / tcs challan online on tin-nsdl

How to pay tds payment online in hindiTds itns challan Tds e-payment, challan, sections, certificates etc.,How to download paid tds challan and tcs challan details on e-filing.

Free download tds challan 280 excel format for advance tax/ selfTds payment How to pay your tds online: a step by step guideTraces : pay tds / tcs challan online on tin-nsdl.

How to pay tds challan 281 online through net banking in telugu

Income tax payment challan (guide)Tds payment challan for amit State bank of india tds challanTds challan tcs quicko.

State bank of india tds challanChallan tds tcs quicko nsdl successful How to pay online tds/tcs/demand payment with challan itns 281How to pay tds challan online.

How to payment tds through online part

How to generate a new tds challan for payment of interest and late .

.