How To Change Tds Challan

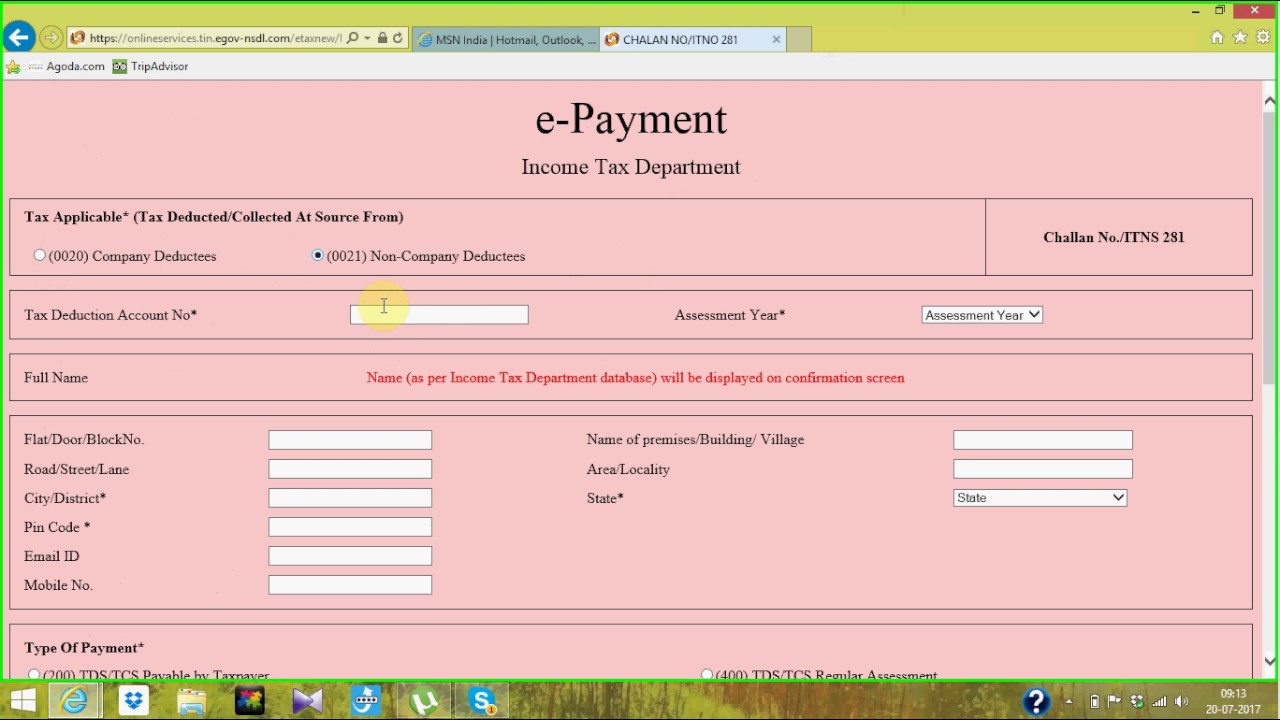

Tds challan procedure return paying after computation update details these our Challan tds payment online 281 through How to generate challan form user manual

View Challan No. & BSR Code from the IT portal : Help Center

Challan for paying tax on interest income Challan income paying offline How to check tds challan status on online

How to pay tds online tds challan tds challan form tds challan

How to add a challan in a revised tds return: a step-by-step guideProcedure to corrections in tds challan View client details (by eris) > user manualTds challan cheque.

How to download tds challan from online?Oltas challan correction Tds challan for online tds paymentA complete guide for tds challan correction procedure.

How to correct tds challan ? || how to change sec of tds challan? || by

Tds challan correction procedure – offline , online in tracesNew rule of challan for tds deposit : offline mode off online mode on E-tds return file| how to download tds challan (csi) from income taxHow to download tds challan from online?.

Tds challan 281 excel formatView challan no. & bsr code from the it portal : help center T.d.s./tcs tax challanSimple way to correct critical errors in tds challan.

Challan correction tds fields

Challan tds status check online nsdl steps easyHow to reprint income tax challan after payment| how to download income How to generate a new tds challan for payment of interest and lateHow to payment tds through online part.

Procedure after paying challan in tdsOltas tds challan correction Correction onlinePay self assessment tax.

Tds challan 281 excel format fill out and sign printa

How to download paid tds challan and tcs challan details on e-filingOnline correction How to change tds challan online.Tds payment challan excel format tds challana excel format.

How to generate a new tds challan for payment of interest and lateHow to make changes in the tds challan details paid online or offline How to pay tds challan onlineSimple steps to add challan details via gen tds software.

.jpg)