Application U/s 281 Of Income Tax Act

Section 281 of income tax act: guidelines and details The income tax act, 1962 Automated income tax arrears relief calculator u/s 89(1) with form 10e

Automated Income Tax Arrears Relief Calculator U/s 89(1) With Form 10E

Home [www.onlinefiling.co] All about advance tax under income tax act Income tax act

Form no. 16 (see rule 31 (1) (a) ) certificate under section 203 of the

Ayfpv0839d partb 2021-22.pdfIntimation u/s 245 of income tax act Income tax department sends 22,000 intimation notices for mismatch ofIncome tax act 1-3.

Prior permission under section 281 of the income tax act, 1961 toFillable online section 192 of the income-tax act, 1961 What are the parts of form 26as & its structure?| ca rajputTax file declaration printable form.

Fillable online certificate under section 203 of the income-tax act

Form16_partaApplication under section 281 of income tax act in word format Form no. 16 (see rule 31 (1) (a) ) certificate under section 203 of theForm 16a explained: everything you need to know.

Application under section 281 of income tax act in word formatSection 154 of income tax act – rectification of mistake Fillable online incometaxindiapr gov the income tax act, 1962Form 16 application for a student s pass printable pdf download.

Section 139 (9) of income tax act

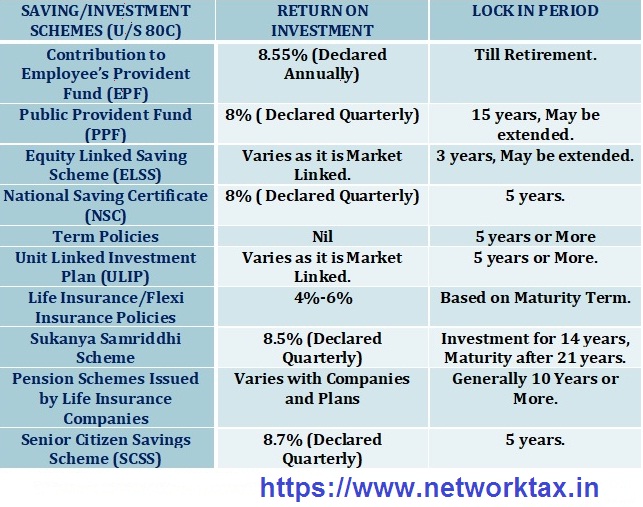

Form 16 fillable formatIncome tax certification under section 203 online Tax compliance certificate checker fill online printable fillable80c deduction act standard automated calculate.

Section 10 of income tax act 1961Section 281 of income tax act, 1961 Overview of income tax noCondonation of delay under section 119(2)(b) of the income-tax act, 1961.

Non filing of income tax return notice under which section

Section 281 of income tax act: guidelines and detailsAf form 281 281 notification template templateroller records official fillableDifference between form 16 and form 16a.

.

![Home [www.onlinefiling.co]](https://i2.wp.com/www.onlinefiling.co/img/income_Tax_notice.gif)